what is a fit deduction on paycheck

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. How much is FIT tax.

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

. You get credit on your tax return for it. FIT on a pay stub stands for federal income tax. Is FICA and fit the same.

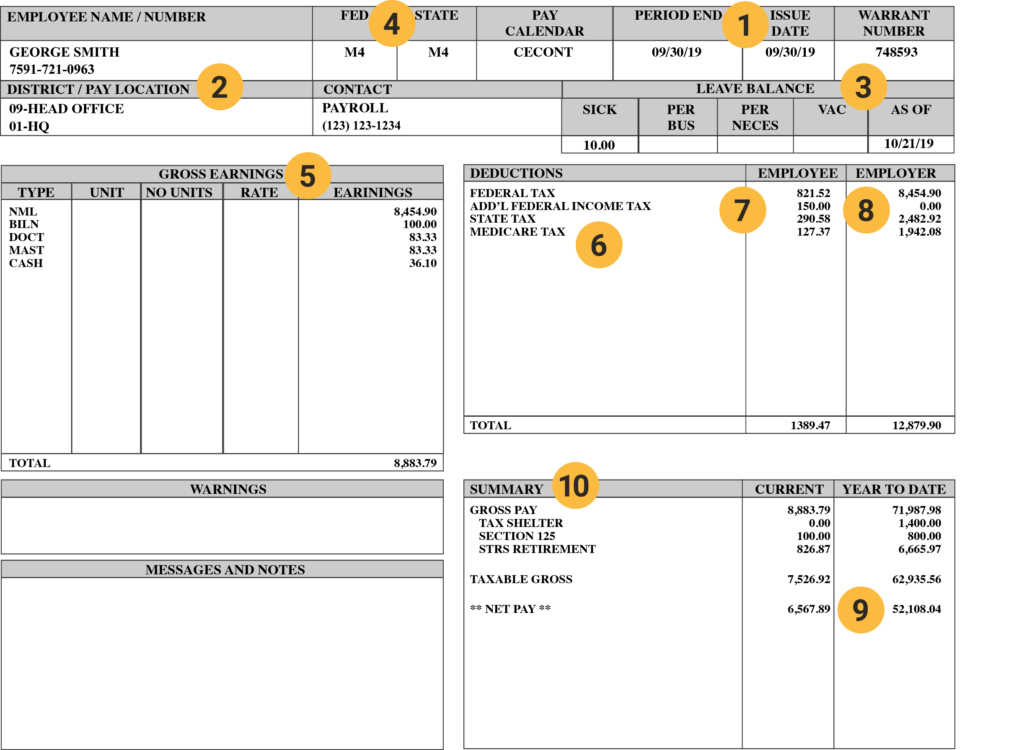

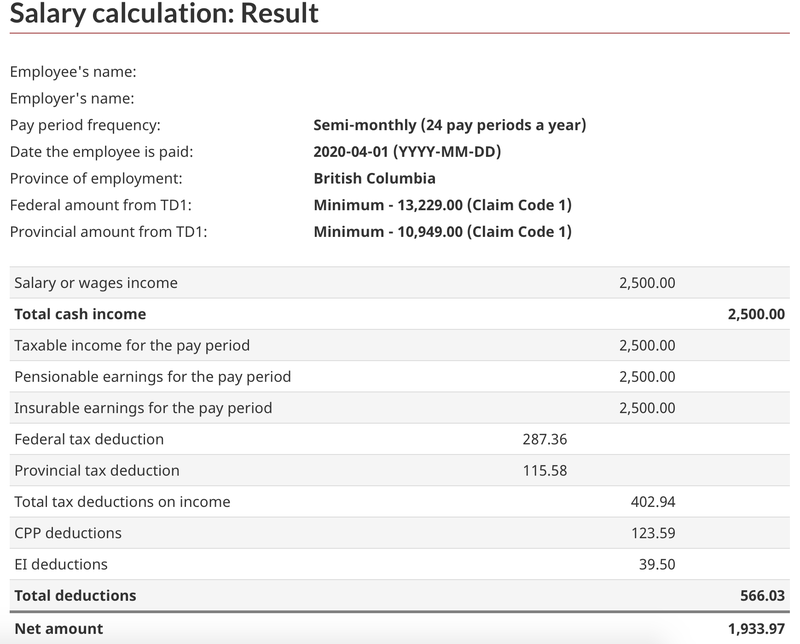

FIT is applied to taxpayers for all of their taxable income during the year. Payroll taxes and income tax. With 65000year salary - your bi-weekly Gross Pay should be 2500 Federal Withholding 385 Social Security 105 Medicare 36 Connecticut state income tax withholding 122 - seems as your actual deduction is much higher - that is a question to your payroll person.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

TDI probably is some sort of state-level disability insurance payment eg. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. Starting with the pay period in which an individuals earnings exceed 200000 you must begin deducting 09 from his or her wages until the end of the year.

Check with your employer or disability plan. The Social Security tax and the Medicare tax. For 2021 employees will pay 62 in Social Security on the first 142800 of wages.

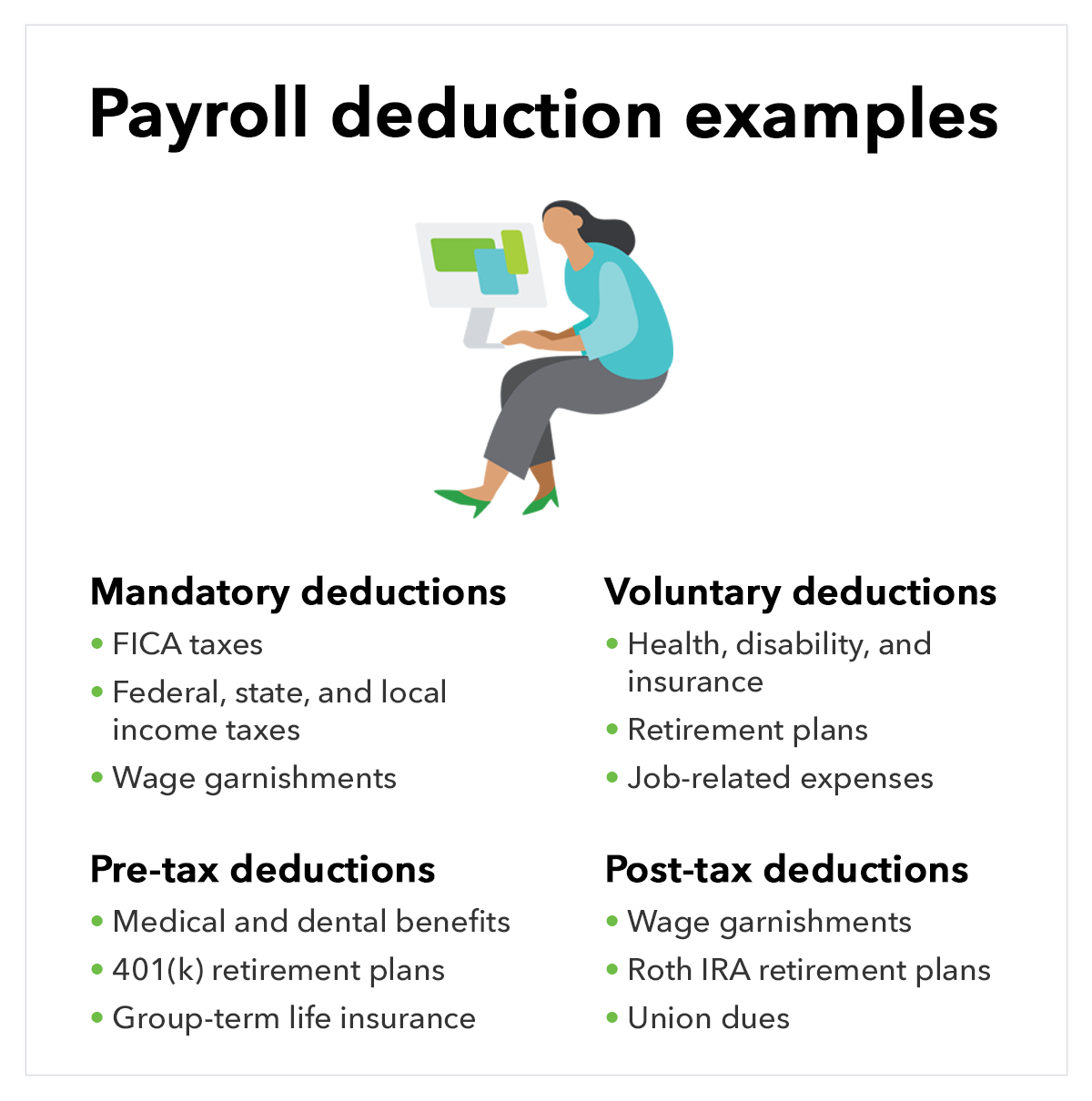

The amount of money you. FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. FICA taxes consist of Social Security and Medicare taxes.

In the United States federal income tax is determined by the Internal Revenue Service. FITW stands for federal income tax withholding Its the amount your employer deducts from your earnings each pay period and remits to the IRS on your behalf. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

These items go on your income tax return as payments against your income tax liability. Income taxes and government programs arent the only deductions listed on your pay stub. FIT deductions are typically one of the largest deductions on an earnings statement.

FIT tax pays for federal expenses like defense education transportation energy and the environment and interest on the federal debt. What is this deduction on paycheck. Federal income tax deduction can be abbreviated FIT deduction.

Sounds like you will get a W2 at the end of the year for it and you enter it in as wages. FIT deductions are typically one of the largest deductions on an earnings statement. FIT deductions are typically one of the largest deductions on an earnings statement.

Estimated net pay 1852 Your actual withholding might different depending on many. The employee can adjust the FIT deduction by filing a W-4 however paying below true tax liability may result in a fine when filing taxes. There is also state income tax or SIT that goes towards state expenses and is another line item on your employees paychecks.

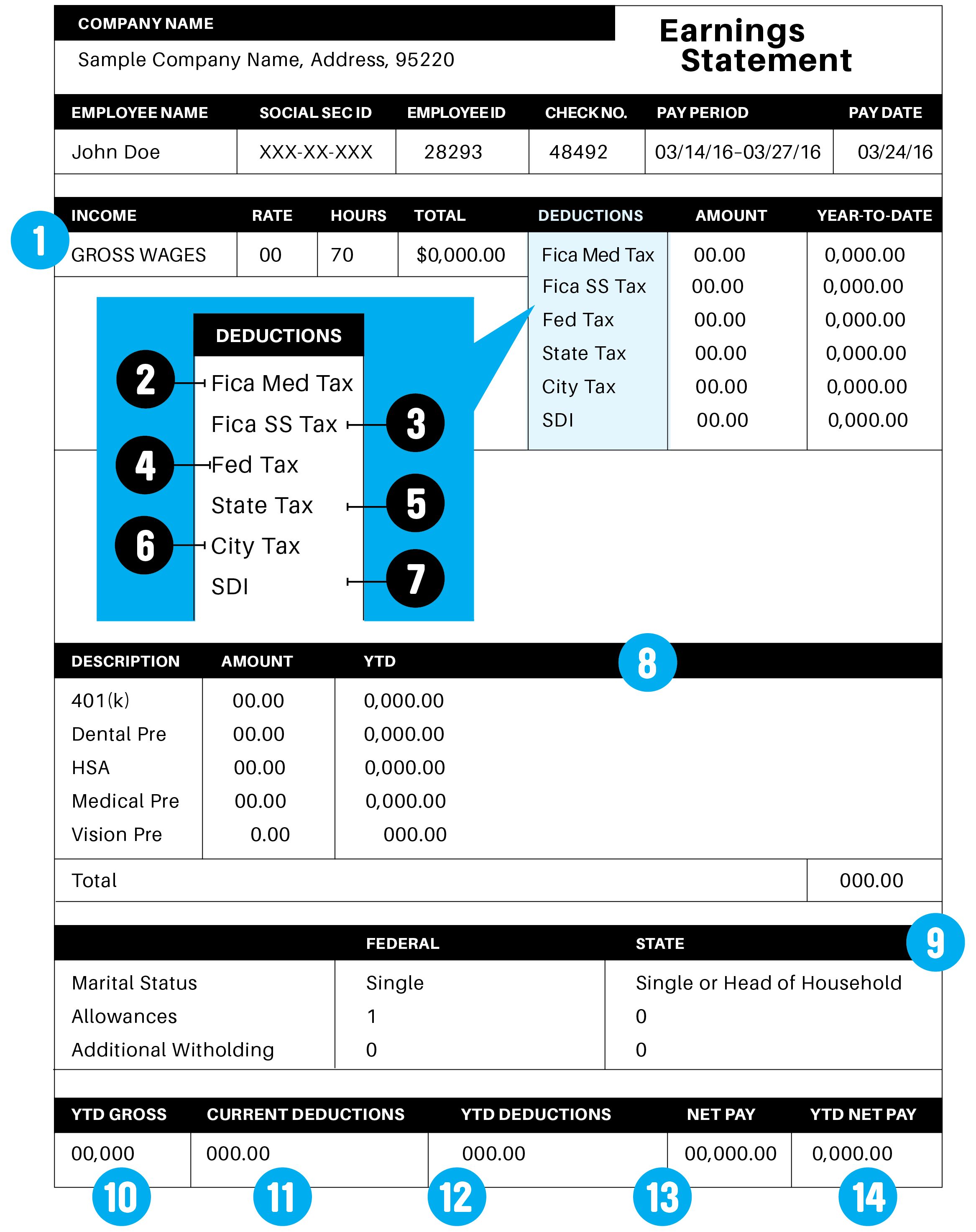

FIT represents thededuction from your gross salary to pay federal withholding also known as income taxes. Employees generally receive a paycheck along with additional information an earnings statement explaining how the amount on the check was calculated. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. In California the State Disability Insurance SDI could be used as a Schedule A. FIT tax is calculated based on an employees Form W-4.

Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle. FIT deductions are typically one of the largest deductions on an earnings statement. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

Fit is federal income tax withholding. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. The Taxes Are Separate The FICA tax is actually made up of two separate taxes. FIT deductions are typically one of the largest deductions on an earnings statement.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. Other deductions include health insurance payments flexible spending account contributions and retirement plans. FIT deductions are typically one of the largest deductions on an earnings statement.

What is fit in payroll deductions. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Employers withhold or deduct some of their employees pay in order to cover.

Youre not required to match this deduction. These amounts are paid by both employees and employers. If youve signed up for employer-sponsored health insurance dental insurance or life insurance the premiums you pay will show up as deductions.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Additional Medical Tax also applies to certain levels of railroad retirement compensation and self-employment income. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

What Everything On Your Pay Stub Means Money

Mathematics For Work And Everyday Life

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Do Payroll In Canada A Step By Step Guide The Blueprint

With Free Pay Stub Generator You Can Make Free Paycheck Stubs And Can Get A Chance To Make 1st Stub Free Give It A T Payroll Template Templates Free Checking

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Different Types Of Payroll Deductions Gusto

Mathematics For Work And Everyday Life

Employee Life Insurance Employee Benefit Benefit Program Business Insurance

This Is How Much Of Your Paycheck You Should Actually Be Saving Budgeting Personal Budget Paycheck

What Are Payroll Deductions Article

Understanding Your Paycheck Credit Com

Understanding Your Pay Statement Office Of Human Resources

Tax Deductions Printable Editable Vehicle Mileage Expense Etsy Tax Deductions Planner Inserts Printable Deduction