how to read td ameritrade tax documents

Have you talked to a tax professional about this. Ad Increased Volatility has Increased Questions.

.png)

Tax Loss Harvesting Wash Sales Td Ameritrade

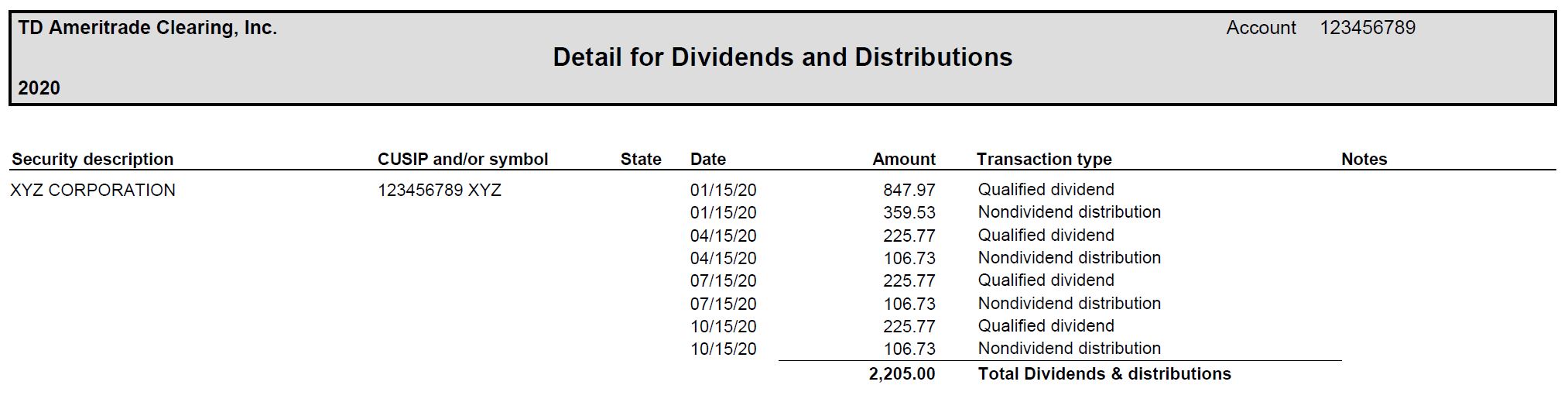

And TD Ameritrade Clearing Inc.

. Required under ERISA Rule 408b-2 that must be disclosed to an ERISA plan fiduciary before their ERISA plan. Heres a short simple summary of what wash sales are. TD Ameritrade will report a dividend as qualified if it has been paid by a US.

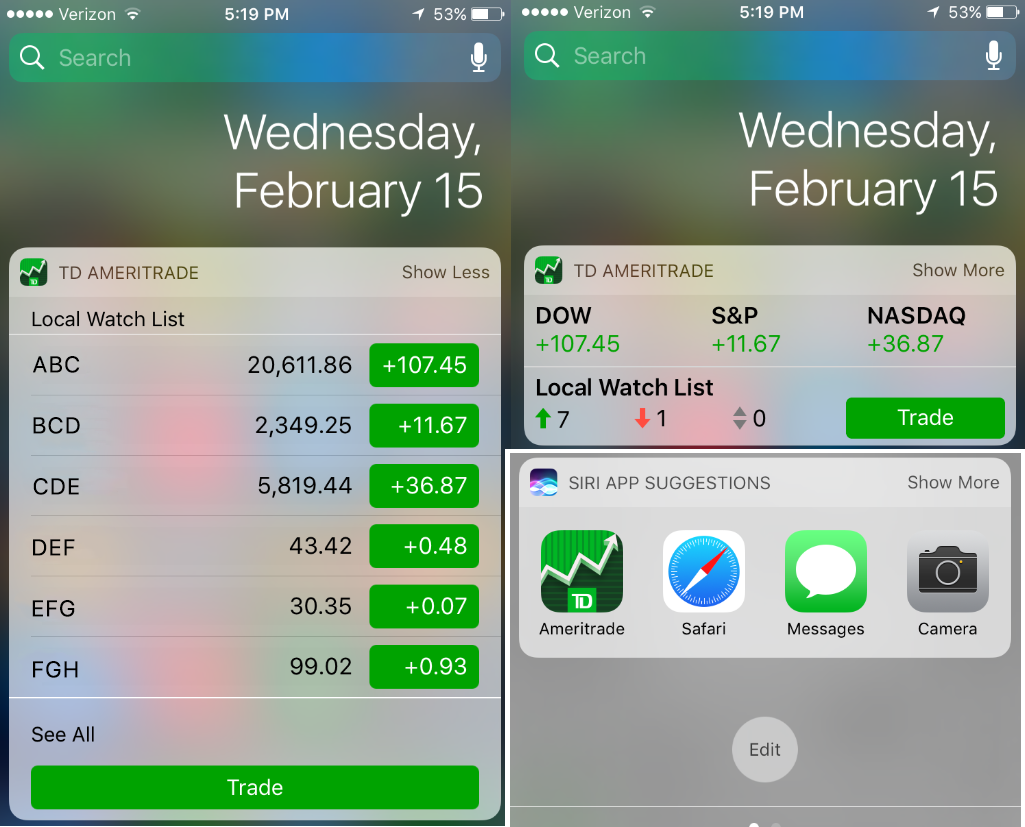

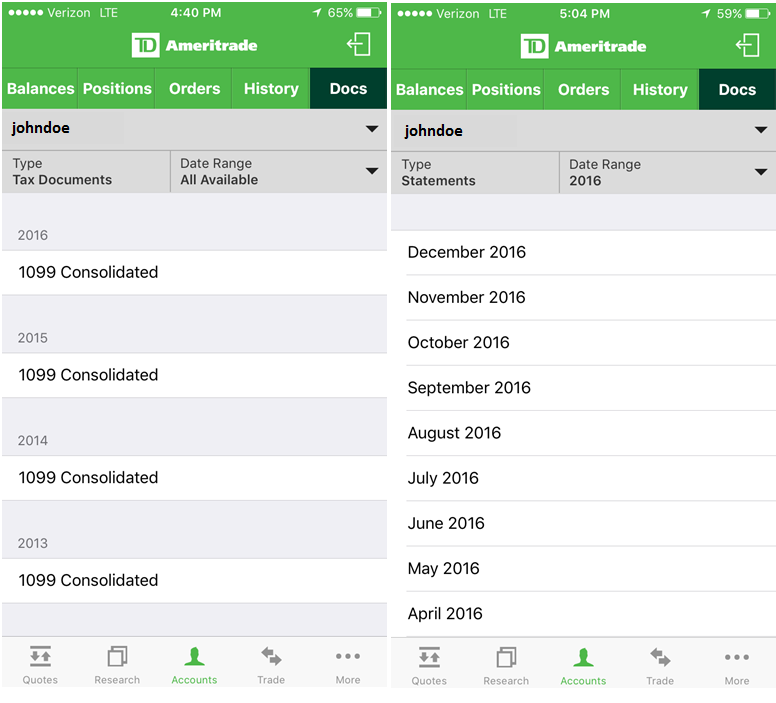

Get you tax documents or bank statements by going to Accounts selecting an account and going to the. Enter your account number and document ID then click Continue. Tax documents and 10 years of reading on your iOS or Android device.

TAX FILING AND FORMS. TD Ameritrade wont report tax-exempt OID for non-covered lots. You will need to know.

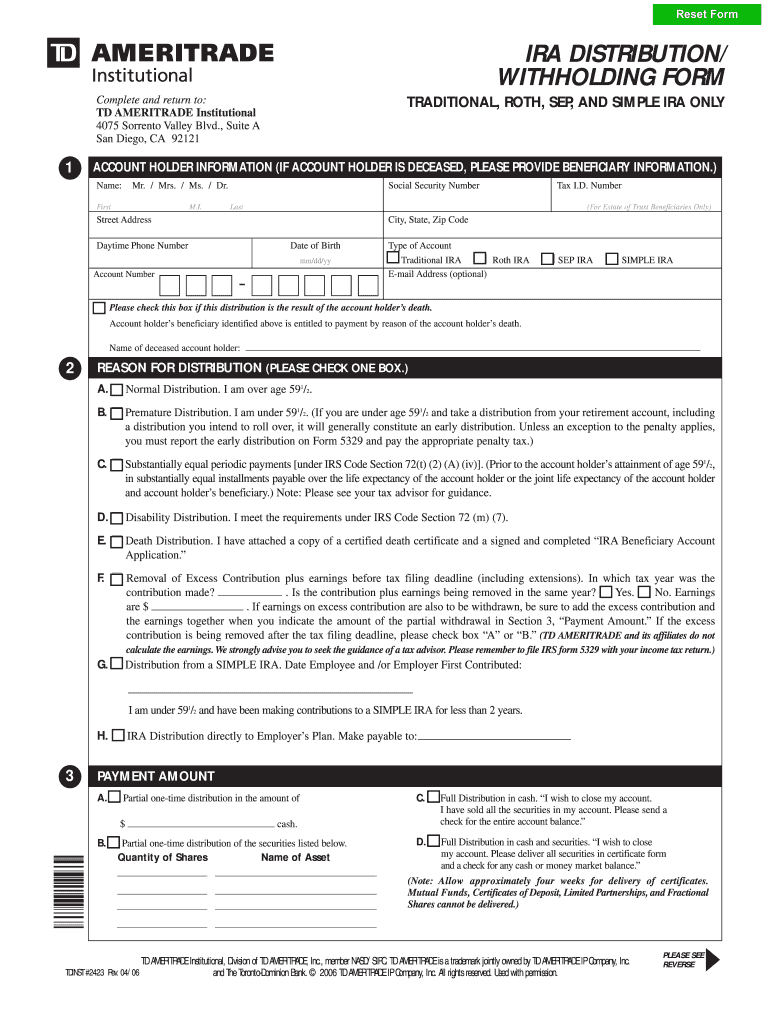

You should have received your 1099 and 1098 forms. Transfer assets from another financial organization for your TD Ameritrade account. Select TD Ameritrade under the popular choices then scroll down and click Continue.

Select TD Ameritrade from the Brokerage or software vendor drop-down menu. Swipe to the Documents tab. Then select the document type you need.

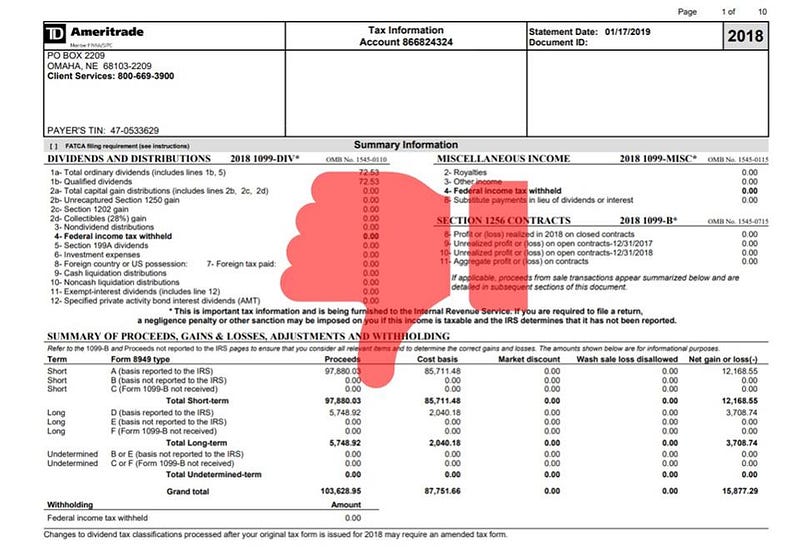

Wash sale tax reporting is complex. You can access your tax documents in your mobile app. Your Consolidated Form 1099 is the authoritative document for tax reporting purposes.

Or qualified foreign corporation. Use this secure online wizard to finish the form desired to transfer assets from one TD Ameritrade. Retrieve your tax documents or statements by navigating to Accounts selecting the account and navigating over to the Docs tab.

This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few. Get the Answers You Need Online. Get the Answers You Need Online.

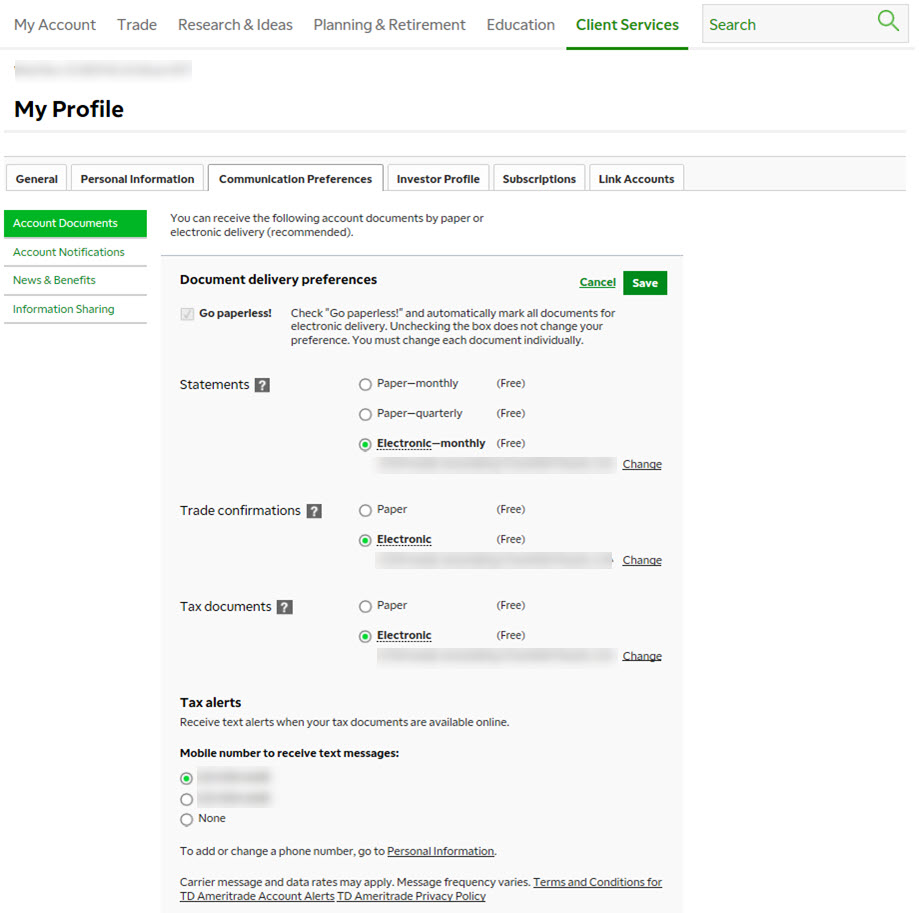

Your tax forms are mailed by February 1 st. You can also access all of your. Tap the Webull icon in the bottom center.

My TD Ameritrade Tax Statement shows. We can go ahead and import. Anything else you want the.

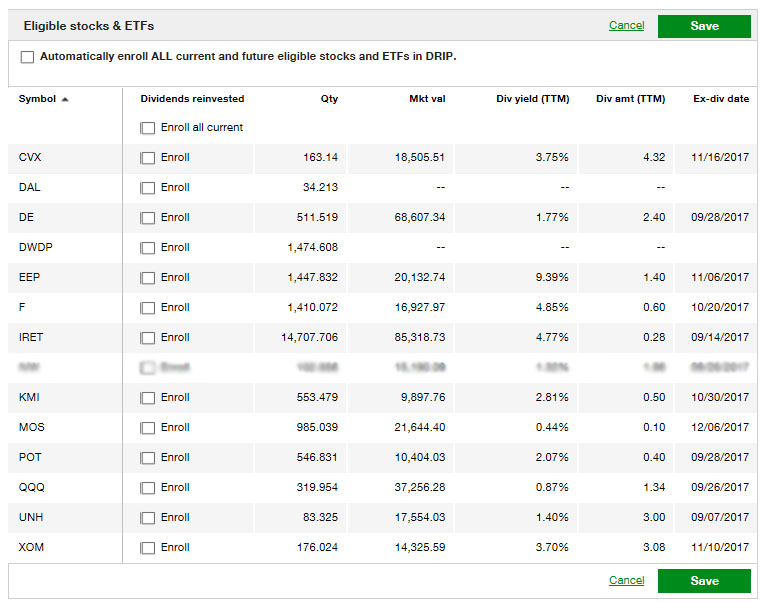

Provides information about TD Ameritrade Inc. Holding period requirements that must be met to be eligible for this lower tax rate. Your tax return journey could involve any of the hundreds of available tax forms but these are among the more common pathways.

Ad Increased Volatility has Increased Questions. Due to Internal Revenue Service IRS regulatory changes that have been phased in since 2011 TD. Click the first screenshot below for reference Nice.

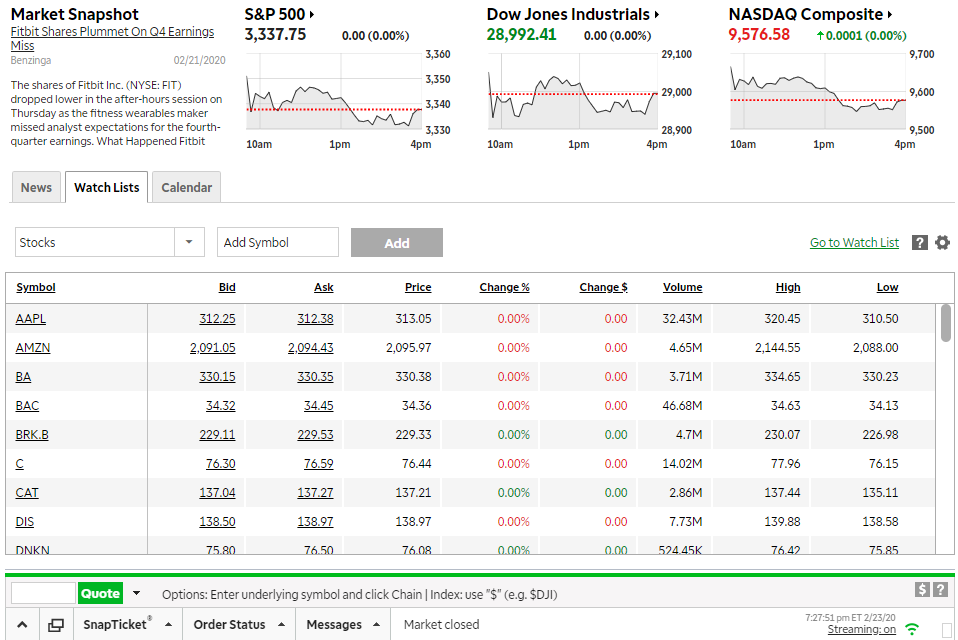

Guide to reading your statement Your statement from TD Ameritrade is organized by sections to give you all of the information you need to know about your account in a way thats simple to. JJ Kinahan Chief Market Strategist TD Ameritrade Monday Market Close The SP 500 SPX broke the 4300 support level that had been in place since July 2021 and tested. 1099-INT forms are only sent out if the interest earned is at least 10.

How To Read Your Brokerage 1099 Tax Form Youtube

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Td Ameritrade Internal Transfer Form Fill Online Printable Fillable Blank Pdffiller

Get Real Time Tax Document Alerts Ticker Tape

It S Harvest Time Potentially Grow Your Savings Usin Ticker Tape

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

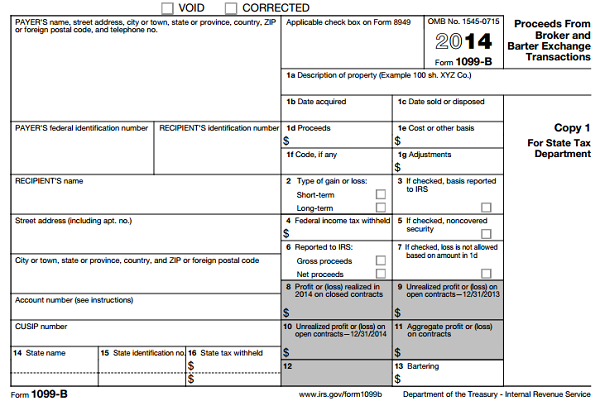

Deciphering Form 1099 B Novel Investor

2022 Td Ameritrade Review Pros Cons Benzinga

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker